by Ravindra Warang

6 minutes

Top Global Hotspots for Blister Packaging Machine Manufacturing

Explore the top global regions leading blister packaging machine manufacturing and how geography shapes pharma supply chain decisions.

When Arvind Mehta, a supply chain head at a mid-sized pharmaceutical firm in Mumbai, received a last-minute tech transfer request for a blister-packed antiviral, he had only two weeks to identify, procure, and commission a new high-speed blister packaging line. As global shipping lanes remained slow post-pandemic and regulatory timelines tightened, the decision wasn’t just about machinery—it was about geography. Geographical considerations in machine procurement are crucial, especially in the supply chain in the pharma industry.

Where a machine is built often determines how fast it can be delivered, how easily it can be serviced, and how well it performs across varying regulatory climates. For procurement heads like Arvind, knowing where blister packaging machines are made—and why those regions lead in blister packaging machine manufacturing—can mean the difference between a delay and a successful launch. Understanding the top blister packaging machine regions is essential for ensuring regulatory compliance in packaging machines.

So, where does the world turn for blister packaging technology? Let’s explore the top global hotspots for blister packaging that drive this critical segment of pharma manufacturing.

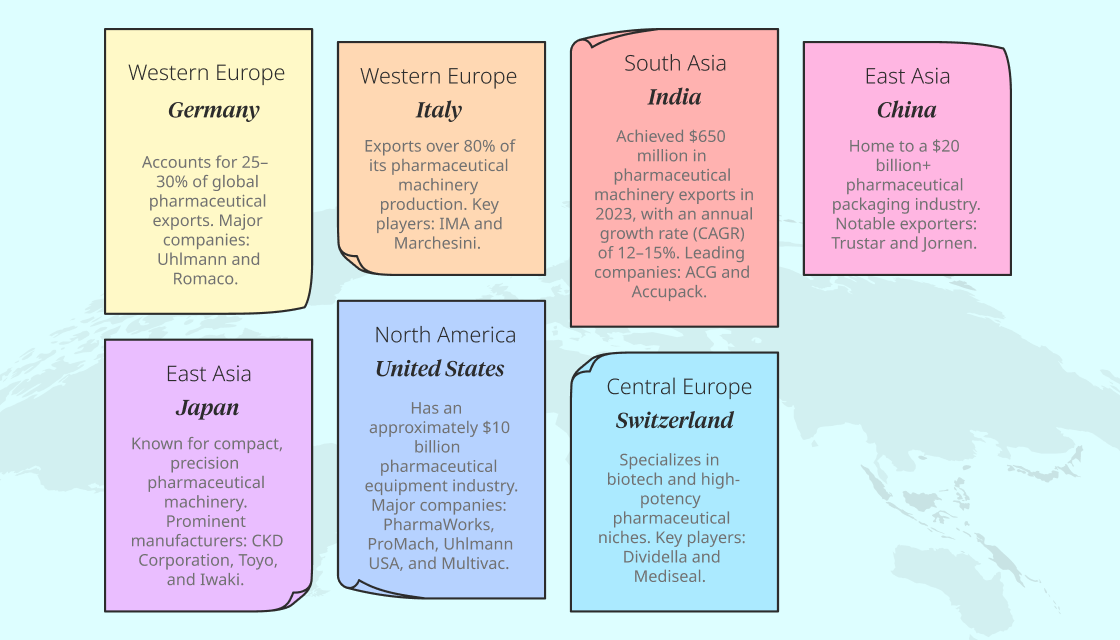

Germany: Precision Engineering with Global Reach in Pharmaceutical Machinery

Germany has long been considered the powerhouse of pharmaceutical machinery. It accounts for roughly 25–30% of global pharmaceutical machinery exports, making it a key player in the Automatic Blister Packing Machine market size. German engineering is renowned for its alignment with EMA and FDA standards and relentless focus on automation.

Uhlmann Pac-Systeme and Romaco Group are leading manufacturers with vast global reach. Uhlmann has over 1,000 installations worldwide, while Romaco exports to more than 150 countries. Their machines are known for durability, compliance, and comprehensive service networks supporting continuous innovation.

Italy: Automation & Flexibility in One

Italy leads as the world’s largest exporter of packaging machinery, with over 80% of its production heading overseas. Italian manufacturers excel at combining design flexibility with GMP compliance, ideal for varied dosage forms and mid-size runs.

The Packaging Valley Bologna houses giants like IMA Group and Marchesini Group who focus on modularity and fast format changeovers—vital for multi-SKU portfolios or trial production runs. This ecosystem ensures versatility, agility, and precision in machine design to meet evolving market demands.

India: Cost-Efficiency Meets Global Scale in Blister Packaging Machinery

India's blister packaging machinery market is growing rapidly with over $650M in packaging equipment exports in 2023 and a CAGR of 12–15%. Cities like Mumbai and Ahmedabad have become hubs for affordable GMP-aligned machines that scale globally.

Companies such as ACG Worldwide (with installations in 138+ countries) and Accupack (1,260+ machines shipped in 2023) lead this growth by blending innovation with affordability. India's strength lies in responsive service and customizability while maintaining competitive pricing.

China: Scaling Up with Speed in the Packaging Machinery Market

China boasts one of the largest packaging industries globally valued over $20B. Manufacturers like Trustar and Jornen export extensively to meet rising demand for cost-efficient solutions tailored to high-volume production environments.

China focuses on rapid scaling capabilities supported by extensive domestic supply chains which enable quick delivery times and competitive pricing structures—a vital factor amid increasing global pharmaceutical demand.

United States: Innovation with Regulatory Backbone in Pharmaceutical Equipment Market

The U.S. pharmaceutical equipment sector is valued around $10B with firms such as PharmaWorks and ProMach leading innovation under stringent FDA regulations. American manufacturers emphasize safety standards alongside cutting-edge automation technologies.

The U.S. market benefits from strong regulatory oversight combined with advanced R&D infrastructure that drives next-generation blister packing solutions designed to meet complex compliance needs efficiently.

Japan: High-Speed Compact Efficiency in Blister Packaging

Japan specializes in compact yet highly efficient blister packaging machinery suited for precision applications requiring small footprints without compromising speed or quality. Companies like CKD Corp., Toyo, and Iwaki focus on delivering reliable systems optimized for space-constrained production lines.

Japanese expertise lies in combining mechanical finesse with automation technology to enhance throughput while maintaining stringent quality controls demanded by pharma clients worldwide.

Switzerland: Boutique Engineering for Complex Needs in Blister Packaging

Switzerland delivers unmatched engineering sophistication particularly suited for niche biotech applications and sterile packaging environments requiring high-potency drug handling capabilities.

Companies such as Dividella and Mediseal specialize in low-waste sustainable formats integrating robotics to boost efficiency while maintaining exceptional quality standards favored by biotech hubs worldwide.

Summary Chart: Global Hotspots for Blister Packaging Machines

Conclusion

Selecting a blister packaging machine goes beyond technical specifications; it depends heavily on regional ecosystems that support service excellence and regulatory compliance. Germany offers precision engineering rooted in durability; Italy provides modular automation flexibility; India delivers cost-effective scalable solutions; China excels at rapid scaling; the U.S. leads innovation under strict regulation; Japan combines compactness with speed; Switzerland caters to biotech’s complex needs.