BioAtla Announces $9.2M Fundraising To Advance Tumor Therapies

BioAtla finalized a direct offering to raise $9.2M, selling shares with warrants at $0.9520 each.

Breaking News

Dec 21, 2024

Simantini Singh Deo

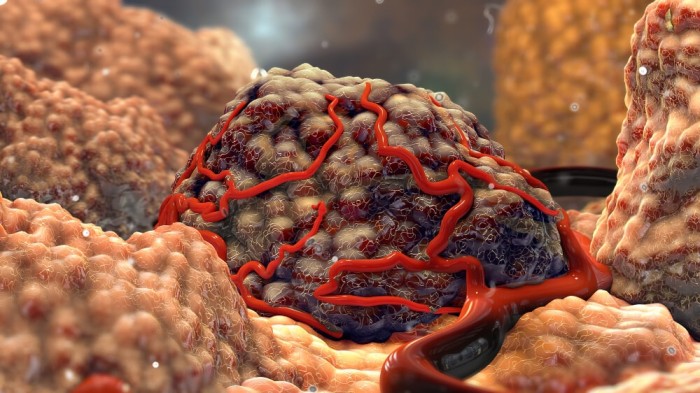

BioAtla, Inc., is a clinical-stage biotech company developing innovative antibody therapies for solid tumours. The firm has announced it has finalized agreements with institutional investors to raise funds through a direct offering. The company is selling 9,679,158 shares of its common stock, paired with warrants allowing investors to buy additional shares at $1.19 each. The combined price per share and warrant is set at $0.9520. The warrants become exercisable six months after issuance and remain valid for 5.5 years. The deal is expected to close around December 20, 2024, pending standard conditions.

BioAtla expects gross proceeds of approximately $9.2 million from this offering before deducting related expenses. The funds, combined with existing resources, will support the company's research and development efforts. This includes advancing key clinical programs such as Phase 1 and Phase 2 trials for BA3182 (a T-Cell Engager targeting CAB-EpCAM and CAB-CD3) and Phase 2B trials for mecbotamab vedotin (an Antibody Drug Conjugate targeting CAB-AXL) in KRAS-mutated non-small cell lung cancer. Data from these studies are anticipated between mid-2025 and the first half of 2026. Additional utilizations for the funds include partnership activities, working capital, and general corporate purposes.

Tungsten Advisors, through its broker-dealer Finalis Securities LLC, acted as the exclusive placement agent for the offering. The securities are being issued under a previously approved shelf registration with the SEC. Details of the offering will be available through a prospectus supplement filed with the SEC at www.sec.gov. This announcement does not constitute a solicitation or sale of these securities in jurisdictions where such actions are prohibited.